Introduction:

In a world of rising interest rates and soaring real estate prices, Canadians are increasingly turning to innovative solutions to make homeownership more accessible. One such solution is the co-mortgage, a financial arrangement where two or more individuals jointly apply for and share responsibility for a home loan. In this blog, we’ll explore how co-mortgages work, why they are gaining popularity in Canada, and discuss their advantages and disadvantages, particularly in a high-interest rate market.

How Co-Mortgages Work:

Co-mortgages are a collaborative approach to homeownership, often involving family members, friends, or life partners. Here’s a brief overview of how they work:

- Joint Application: Two or more individuals apply for a mortgage together, combining their financial resources to increase their borrowing capacity. This can be especially helpful for those who might not qualify for a mortgage on their own.

- Shared Responsibility: All co-borrowers share the financial responsibility for making mortgage payments. This shared burden can make homeownership more affordable.

- Ownership Structure: Co-mortgages can also involve shared property ownership. Each co-borrower can decide on their percentage of ownership, which can be different from their contribution to the mortgage.

- Legal Agreement: It’s crucial to have a legally binding co-ownership or cohabitation agreement. This document outlines the terms of the arrangement, including financial contributions, responsibilities, and what happens in case of disputes or if one co-borrower wants to sell their share of the property.

Why Are Some Canadians Considering Co-Mortgages?

Co-mortgages are gaining traction in Canada for several reasons:

- Increased Borrowing Capacity: With the rising cost of real estate, co-mortgages allow borrowers to pool their financial resources, improving their chances of securing a mortgage and affording a home.

- Affordability: Sharing the financial burden of homeownership can make it more affordable, especially in high-demand housing markets.

- Tax Benefits: In Canada, interest paid on a co-mortgage may be tax-deductible if the property is jointly owned and serves as the primary residence. This can result in significant tax savings.

- Easier Qualification: Co-mortgages make it easier for individuals with less-than-ideal credit or limited income to become homeowners.

- Flexibility: Co-borrowers can tailor the arrangement to their specific needs, deciding how to split ownership and financial responsibilities.

Advantages of Co-Mortgages in a High-Interest Rate Market:

- Interest Savings: Sharing the mortgage interest with a co-borrower can result in substantial savings, especially when interest rates are high.

- Increased Buying Power: Co-borrowers can access larger mortgages, helping them enter the housing market despite escalating prices.

- Risk Sharing: When facing financial challenges, co-mortgage holders can rely on each other for support in making payments, reducing the risk of default.

Disadvantages of Co-Mortgages in a High-Interest Rate Market:

- Shared Liability: If one co-borrower defaults on the mortgage, all parties are responsible. This can strain relationships and finances.

- Legal Complexities: Co-mortgages require detailed legal agreements, and any change in ownership structure or property disposition can be complex and costly.

- Relationship Strain: Personal relationships between co-borrowers can be tested, and disagreements over property use, maintenance, or selling may arise.

Conclusion:

In a high-interest rate market, it’s essential to carefully consider the advantages and disadvantages of co-mortgages. Seek professional advice, communicate openly with co-borrowers, and ensure that you have a well-drafted legal agreement in place to navigate potential challenges.

Co-mortgages can be a viable path to homeownership, offering financial relief in a competitive and costly housing market. However, they require careful planning, open communication, and a clear understanding of the legal and financial implications to ensure a successful arrangement.

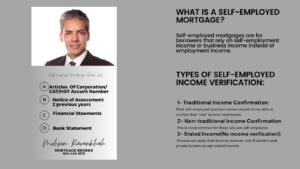

The Stated Income Program is tailored to meet the unique needs of individuals whose income might not fit the mold of traditional employment. Here are some of the key groups that can benefit:

The Stated Income Program is tailored to meet the unique needs of individuals whose income might not fit the mold of traditional employment. Here are some of the key groups that can benefit: In the Stated Income Program:

In the Stated Income Program: