Introduction

Becoming a homeowner is a dream shared by many, but for business owners and self-employed individuals in Canada, it can sometimes feel out of reach due to unconventional income streams. However, there’s a ray of hope in the form of the “Stated Income Program.” In this blog post, we’ll explore this specialized mortgage option, shedding light on who can benefit, how it operates, and why it’s a game-changer for those with fluctuating income sources.

Who Can Benefit from the Stated Income Program?

The Stated Income Program is tailored to meet the unique needs of individuals whose income might not fit the mold of traditional employment. Here are some of the key groups that can benefit:

The Stated Income Program is tailored to meet the unique needs of individuals whose income might not fit the mold of traditional employment. Here are some of the key groups that can benefit:

- Small Business Owners: Entrepreneurs with variable income streams can find the Stated Income Program accommodating, enabling them to qualify for a mortgage based on their estimated income.

- Freelancers and Gig Workers: Those in the gig economy or freelancing often lack the conventional paystubs and W-2 forms. This program provides a pathway to homeownership for them.

- Real Estate Investors: Individuals who generate rental income can factor in this revenue when applying for a mortgage, making it easier to expand their property portfolios.

- Commission-Based Sales Professionals: Salespeople whose income relies heavily on commissions can leverage the Stated Income Program to qualify for a mortgage based on their earning potential.

- Entrepreneurs: Business owners with income tied up in their ventures or investments can benefit from a more holistic assessment of their financial situation.

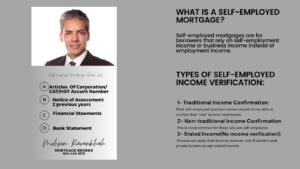

How Does the Stated Income Program Work?

In the Stated Income Program:

In the Stated Income Program:

- Limited Documentation: Applicants state their income on the mortgage application, streamlining the process compared to traditional mortgages.

- Credit Matters: Credit history and scores still play a crucial role in the approval process. Maintaining a strong credit profile enhances the likelihood of approval and favorable terms.

- Interest Rates: While offering flexibility, this program may come with slightly higher interest rates to account for the risk associated with limited income verification.

Conclusion

The Stated Income Program is a beacon of hope for business owners and self-employed individuals in Canada, making homeownership more accessible despite unconventional income sources. It offers a flexible approach to income verification, acknowledging the unique financial situations of applicants. However, it’s essential to weigh the interest rates and terms associated with this program before making a decision. Consulting with a mortgage broker can provide valuable guidance, ensuring you make informed choices on your path to homeownership.